Tata Investment share price Target 2025 to 2050 : Tata Investment was formed by Tata Group specifically for non-banking purposes and invests mostly in long-term equity shares or securities related investments. This company invests primarily in listed and unlisted equity shares, debt securities, mutual funds and other instruments from companies across industries. As this company solely engages in investment activity, its income typically derives from dividends, interest payments and any gains or losses on long-term investments sold during sale transactions. Furthermore, other investors can invest directly in this firm with fixed share prices that trade regularly on stock exchanges around the globe. Tata Investment share price Target 2025 to 2050

Companies engaged in listing regularly perform an automated share price prediction process known as Tata Investment Share Price Prediction to create an estimate for future share values; Tata Investment performs this prediction process, too, which lasts five years and begins again after 2030 when predictions end and begin again with Tata Investment Share Price Prediction 2030 for example. The prediction process keeps repeating every five years until all listed companies stop listing.

Share prices fluctuate constantly on the stock market and companies often seek maximum value from their shares but it may not always be achievable; as a result many opt to set targets such as Tata Investment Share Price Target 2024 which sets monthly targets and seeks to achieve them throughout a specific year. In 2025 a similar target will be determined in this way with plans being set in order to attain it successfully. The target will be fixed every year such as Tata Investment Share Price Target 2026, Tata Investment Share Price Target2027, Tata Investment Share Price Target 2028, Tata Investment Share Price Target2029, Tata Investment Share Price Target2030,Tata Investment Share Price Target2040 and Tata Investment Share Price Target2050.

Tata Investment Company Overview

| Company Name | Tata Investment Corporation Ltd. |

|---|---|

| Founded | 1937 |

| Headquarters | Mumbai |

| Industry | Consumer Durables Manufacturing |

| Chairman | N N Tata |

| Stock Exchange Listing | NSE & BSE |

| Revenue (September 2023) | ₹322.48 crore |

| Revenue (September 2024) | ₹142.48 crore |

| Official Website | Visit Website |

Tata Investment Company Fundamental Analysis

| Parameter | Value |

|---|---|

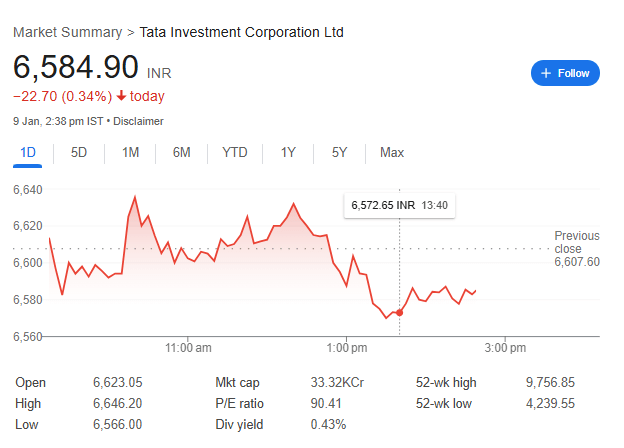

| Open | 6,623.05 |

| Previous Close | 6,607.60 |

| Volume | 21,378 |

| Value (Lacs) | 1,401.56 |

| VWAP | 6,593.39 |

| Beta | 0.69 |

| Market Cap (Rs. Cr.) | 33,170 |

| High | 6,646.20 |

| Low | 6,540.00 |

| UC Limit | 7,929.10 |

| LC Limit | 5,286.10 |

| 52 Week High | 9,756.85 |

| 52 Week Low | 4,239.55 |

| Face Value | 10 |

| All Time High | 9,756.85 |

| All Time Low | 34.87 |

| 20D Avg Volume | 169,059 |

| 20D Avg Delivery (%) | 14.7 |

| Book Value Per Share | 7,266.34 |

| Dividend Yield | 0.43 |

Tata Investment Financials ( Tata Investment share price Target 2025 to 2050 )

Income Statement and Balance Sheet of previous year 2024

Income Statement

| Metric (INR) | 2024 (INR) | Y/Y Change |

|---|---|---|

| Revenue | 3.86B | 38.97% |

| Operating Expense | 338.40M | 3.17% |

| Net Income | 3.85B | 52.84% |

| Net Profit Margin | 99.74% | 9.98% |

| Earnings Per Share | — | — |

| EBITDA | 3.52B | 43.75% |

| Effective Tax Rate | 5.17% | — |

| Cash and Short-term Investments | 328.23B | 55.96% |

| Total Assets | 328.70B | 55.86% |

| Total Liabilities | 29.05B | 91.71% |

| Total Equity | 299.65B | — |

| Shares Outstanding | 50.60M | — |

| Price to Book | 1.10 | — |

| Return on Assets | 0.82% | — |

| Return on Capital | 0.88% | — |

Tata Investment Shareholding Pattern

| Category | Holding (%) |

|---|---|

| Retail & Other | 23.85% |

| Promoters | 73.38% |

| Foreign Institutions | 2.26% |

| Mutual Funds | 0.08% |

| Other Domestic Institutions | 0.43% |

Tata investment corporation ltd share price Target 2025 to 2050

Tata Investmentcorporation ltd’s Share PriceTarget 2025

Tata Investment Corporation Limited (TICL) is projected to experience significant growth by 2025 with estimates ranging from Rs4,150-Rs10500 rupees. TICL should benefit from India’s increasing economy, portfolio diversification, and investors’ increasing trust; its focus on high-growth sectors as well as robust institutional backing may contribute to its performance. Tata Investment share price Target 2025 to 2050

2025 will be an essential year for TICL as it consolidates its position as a major participant in India’s financial system.

| Year | Minimum Target (₹) | Maximum Target (₹) | Remarks |

| 2025 | 4150 | 10500 | Growth supported by TICL’s diversified portfolio and market trends. |

Tata Investmentcorporation ltd’s Share PriceTarget 2026

Tata Investment Corporation Limited (TICL) is anticipated to maintain its growth and trend into 2026 with minimum price predictions between Rs 6055 and 14099 rupees. As Indian economy growth and equity market gains continue, we may witness the cumulative effect of strategic investments made by TICL due to high performing sectors. TICL may attract retail and institutional investors due to consistent dividend distribution as well as its diverse portfolio in high performing sectors with diverse sectors representing high performing sectors compared with an uncertain market while higher range predictions show greater investor trust resulting in 2026 becoming another year with increasing financial performance for TICL! Tata Investment share price Target 2025 to 2050

| Year | Minimum Target (₹) | Maximum Target (₹) | Remarks |

|---|---|---|---|

| 2026 | 6055 | 14099 | Growth driven by diversification, economic recovery, and portfolio expansion. |

Tata Investmentcorporation ltd’s Share PriceTarget 2027

| Year | Minimum Target (₹) | Maximum Target (₹) | Remarks |

|---|---|---|---|

| 2027 | 8,750 | 17,340 | Positive sentiment from portfolio updates. Strong carryover momentum from 2027. |

Tata Investmentcorporation ltd’s Share PriceTarget 2028

| Year | Minimum Target (₹) | Maximum Target (₹) | Remarks |

|---|---|---|---|

| 2028 | 10,440 | 19,435 | Steady growth from previous momentum. |

Tata Investmentcorporation ltd’s Share PriceTarget 2029

| Year | Minimum Target (₹) | Maximum Target (₹) | Remarks |

|---|---|---|---|

| 2029 | 12,352 | 23,453 | Portfolio diversification boosts value. Market stability drives further gains. |

Tata Investmentcorporation ltd’s Share PriceTarget 2030

Tata Investment Corporations target price for shares by 2030 is between Rs 14332 and Rs 26489 for two key reasons. First, this reflects an improvement in growth prospects based on Tata Investment Corporations diverse investment portfolio, its allocation to industries with high projected growth potential and performance over time for Tata Group companies. Second, as economies such as India grow more economically share ownership is likely to rise exponentially allowing Tata Investment Corporation to enhance value at an incremental level over time. Tata Investment share price Target 2025 to 2050

| Year | Minimum Target (₹) | Maximum Target (₹) | Remarks |

|---|---|---|---|

| 2030 | 14332 | 26489 | Sustained growth from long-term investments and India’s economic boom. |

Tata Investmentcorporation ltd’s Share PriceTarget 2040

Once again we find ourselves with no choice other than accepting what has come our way: an upheaval in our lives that requires action to restore order – and here it comes… Tata Investment Corporation anticipates reaching a share price of Rs70000 by 2040; further, their forecast predicts that economies in other nations, including India’s, will expand, leading to growth of equity markets that will enable Tata Investment Corporation to achieve this share price goal which currently ranges between Rs 46482-67345per share. Expanding India’s economy through increasing share and equity ownership and diversification into emerging markets will undoubtedly boost its long-term stability. Focused on producing sizeable returns over the long haul and practicing disciplined investing practices make the firm an excellent long-term investment option for investors looking at growing India in 20 years time. It fits perfectly within India’s projected economic expansion. Tata Investment share price Target 2025 to 2050

| Year | Minimum Target (₹) | Maximum Target (₹) | Remarks |

|---|---|---|---|

| 2040 | 46482 | 67345 | Steady returns from compounding investments and India’s economic leadership. |

Tata Investmentcorporation ltd’s Share PriceTarget 2050

Tata Investment’s long-term target price per share is estimated to range between90345-105432 INR. This assumes decades of growth and value creation over this time. Investment in cutting edge industries such as renewable energy, tech or infrastructure might alter this projection; however, Tata Group’s footprint across key sectors combined with India’s economic expansion should enable continued expansion; strong governance and diversification within Tata Investment provide easier avenues for investing for an even brighter future, particularly during India’s century of development.

| Year | Minimum Target (₹) | Maximum Target (₹) | Remarks |

|---|---|---|---|

| 2050 | 90345 | 105432 | Long-term growth fueled by compounding, portfolio expansion, and global market stability. |

Tata Investmentcorporation ltd’s Share Price History

| Period | Share Price (INR) |

| Before 1 Year | ₹6,849.05 |

| Before 6 Months | ₹6,849.05 |

| Before 5 Years | ₹1,163.50 |

| All-Time Max | ₹9,756.85 |

Tata Investment Peer Companies

- Authum Investment & Infrastructure

- IIFL Finance

- JM Financial

- JIO Financial Services

- MAS Financial Services

- Muthoot Finance

- Piramal Enterprises

- Poonawalla Fincorp

Base Factors Influence Tata investment corporation ltd’s share price

- Expansive Investment Portfolio

Tata Investment Corporation operates with an investment portfolio that spans multiple fields such as financial services, manufacturing and technology to spread risks while driving long-term growth. Key investments contribute significantly to share price performance. Tata Investment share price Target 2025 to 2050 - Strategic Alignment with the Tata Group

Tata Investment Corporation takes advantage of being part of the respected Tata Group to capitalize on trust and market sentiment associated with Tata brands, helping drive share price growth as investors recognize Tata’s strong image as associated with their own. Tata Investment share price Target 2025 to 2050 - Favorable Market Conditions

Tata Investment’s valuation benefits greatly from favorable equity market trends in Indian markets, where their holdings are held. Rising asset values and portfolio expansion contribute directly to performance enhancement and share price appreciation of Tata Investment. Tata Investment share price Target 2025 to 2050 - Dividend Consistency

Tata Investment Corporation is widely respected for its consistent dividend payments. Regular dividend payments attract income-focused investors, leading to greater demand for its stock and consequently driving share price growth. - Growth from India’s Financial Market Expansion

Tata Investment Corporation has seen asset growth attributed to India’s financial market through investments across different sectors that allow the company to capitalize on broad market uptrends. - Appeal to Institutional Investors

Tata Investment Corporation attracts institutional investors with strong governance and top-quality investments that draw institutional buyers, increasing demand and creating upward pressure on share prices.

Risks and Challenges of Tata investment corporation ltd’s share price

1. Market Volatility

Since Tata Investment Corporation primarily holds equity investments, its portfolio is highly susceptible to market fluctuations. Sudden declines or underperformance in key sectors could significantly reduce Tata’s asset values, leading to a decline in share value and share price. Tata Investment share price Target 2025 to 2050

2. Economic Downturns

During economic slowdowns or recessions, businesses across various sectors often face challenges such as reduced profits and declining consumer demand. These factors can result in diminished returns for Tata Investment Corporation, ultimately impacting its share price negatively. Tata Investment share price Target 2025 to 2050

3. Sector-Specific Risks

The company’s portfolio may have concentrated investments in specific industries like finance, manufacturing, or IT. These sectors may carry higher regulatory or economic risks. Any underperformance due to factors such as regulatory changes, technological disruptions, or economic challenges could lower Tata’s portfolio value, putting pressure on its share price. Tata Investment share price Target 2025 to 2050

4. Interest Rate Fluctuations

Changes in interest rates can significantly impact investment returns. Higher interest rates increase borrowing costs, potentially restricting business expansion plans and reducing the valuations of growth stocks in Tata’s portfolio. This can negatively affect share prices.

5. Global Market Exposure Risks

Expanding into international markets exposes Tata Investment Corporation to risks such as geopolitical tensions, currency fluctuations, and regulatory changes. These factors can adversely affect investment performance, reducing portfolio value and share prices.

6. Dividend Sustainability Risks

Tata Investment Corporation is known for regular dividend payouts, attracting income-focused investors. However, in times of financial strain, if the company reduces dividend payments, it could erode investor confidence, leading to a decrease in share price and further reductions in share value. This structured approach provides a clear understanding of the various risks associated with Tata Investment Corporation’s portfolio and its potential impact on share value and prices. Tata Investment share price Target 2025 to 2050

Should I Buy Tata Investment Stock?

Tata Investment Corporation Ltd (TICL) is a diversified long-term equity investor across multiple sectors, boasting a market cap of Rs34,153.85 crore with an impressive P/E ratio of 92.69 and P/B ratio of 1.14. The stock has seen profit grow at an annualized compounded compound growth rate of 23.5% over five years; however, ROE dropped significantly to 1.39 in three years (ROE = 1.39), suggesting reduced profitability and offering only low dividend yield of 0.411% – appealing long term investors looking for stability!

Expert advice for Tata Investment Corporation Ltd.

Tata Investment Corporation Ltd (TICL) boasts a diverse portfolio of investments related to both Tata and non-Tata companies. While return on equity figures stand at 1.55 per cent, debt levels have decreased and profit has shown impressive growth (23.5 % five-year compound annual compound average growth rate), as reported by analysts. Analysts anticipate some slight upward spike due to their steady environment for investments as well as low debt levels. Tata Investment share price Target 2025 to 2050

Is Tata Investment Stock to Good Buy? (Bull vs. Bear Case)

Bull Case:

Diversifying its portfolio to include both Tata and non-Tata companies provides for better investment diversification while the low debt level and negative financial leverage reduce financial risk, and an impressive 23.5 % compound annual profit growth over five years displays earnings growth potential.

Connectivity and association with Tata Group create investor confidence and governance – assuring long-term growth performance that provides comfort to investors.

Bear Case:

Current Return of Equity of 1.55% restricts its upside potential and recent stock performance lags behind major indices, prompting questions as to its likelihood of price appreciation in future. Tata Investment share price Target 2025 to 2050

Low average dividend yield has limited the stock’s appeal among income investors and macro factors like economic downturns and competition may hinder business expansion, while no notable innovation or expansion initiatives have taken place, in comparison with more dynamic sectors. Tata Investment share price Target 2025 to 2050

Conclusion

Tata Investment Corporation, formed as part of the Tata group, does not engage in banking activity or any other type of commercial operation. This company only takes care in investing in stock exchanges; income for this entity comes in from dividends, interests and any gain realized upon selling long-term investments or any other financial instruments. Attractive companies with significant revenues often tend to perform exceptionally well on stock exchanges and their value of shares increases accordingly, providing shareholders with their dividends without incurring debt, with many being overvalued by approximately 91%. Such firms usually command premium pricing due to increased shareholder demand. Tata Investment share price Target 2025 to 2050

Tata Investment share price Target 2025 to 2050 Tata Investment share price Target 2025 to 2050 Tata Investment share price Target 2025 to 2050 Tata Investment share price Target 2025 to 2050 Tata Investment share price Target 2025 to 2050 Tata Investment share price Target 2025 to 2050 Tata Investment share price Target 2025 to 2050