Moschip Technologies, a premier semiconductor company, has recently increased production and innovations while remaining stable within financial markets and showing growth potential, garnering investor attention. This article will analyze Moschip Share Price Target for 2025 to assess how global market changes, new technology introduction and company strategies could influence stock price.

We will present in-depth analysis, expert opinions, financial health analyses, and market trends analysis in this article. Regardless of whether you are an experienced investor or just starting out in investing, this piece provides essential information and precautions necessary for investing in Moschip shares. Moschip share price target 2025 to 2030

At Moschip’s shares by 2025, our goal is to equip you with reliable and accurate information to assist with making sound financial decisions and potentially make profitable investments in Moschip’s shares. Moschip share price target 2025 to 2030

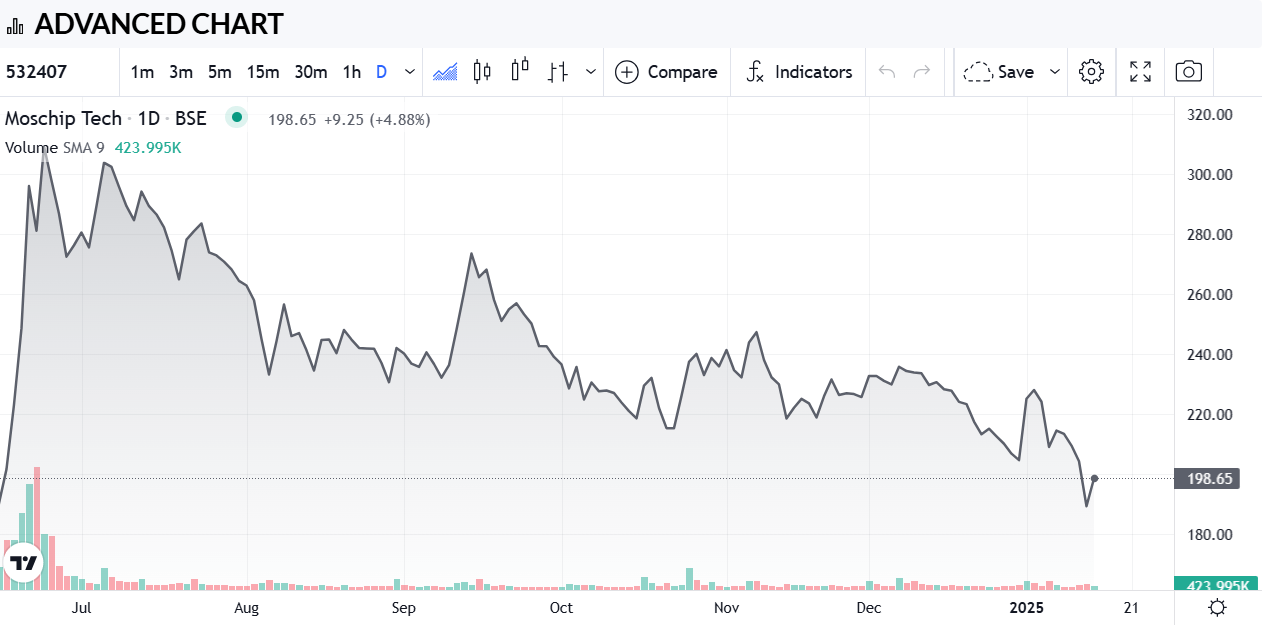

Recent Moschip share price graph

About Moschip : ( Moschip share price target 2025 to 2030 )

| Aspect | Details |

|---|---|

| Company Name | Moschip Technologies Limited |

| Industry | Semiconductor and System Solutions |

| Founded | 1999 |

| Headquarters | Hyderabad, India |

| Core Services | Design and development of semiconductor solutions, system integration, and IP creation |

| Key Markets | Telecommunications, Internet of Things (IoT), Industrial Control, Automotive, and Consumer Electronics |

| Innovation Focus | High-performance interfaces, IoT enhancements, automation technologies |

| Global Reach | Expanding presence in international markets, with a focus on both developed and emerging regions |

| Research and Development | Emphasis on continuous innovation and technology advancement |

| Sustainability Initiatives | Commitment to environmental sustainability and green technologies |

| Stock Listing | Listed on the Indian Stock Exchange |

| Corporate Vision | To lead in the creation of innovative semiconductor solutions that enhance modern living |

Moschip Financial Performance

| Financial Ratios | Description | Formula | 2023 (Example) | 2024 (Example) |

|---|---|---|---|---|

| Liquidity Ratios | ||||

| Current Ratio | Measures the ability to cover short-term obligations | Current Assets / Current Liabilities | 1.5 | 1.7 |

| Quick Ratio | Measures liquidity without inventory | (Current Assets – Inventory) / Current Liabilities | 1.2 | 1.3 |

| Profitability Ratios | ||||

| Gross Profit Margin | Percentage of revenue that exceeds the cost of goods | (Revenue – Cost of Goods Sold) / Revenue | 40% | 42% |

| Net Profit Margin | Net income as a percentage of revenue | Net Income / Revenue | 15% | 17% |

| Return on Assets (ROA) | Earning power from total assets | Net Income / Total Assets | 5% | 6% |

| Return on Equity (ROE) | Earning power from shareholder investment | Net Income / Shareholder’s Equity | 10% | 12% |

| Efficiency Ratios | ||||

| Asset Turnover Ratio | Efficiency of asset use | Revenue / Total Assets | 0.8 | 0.9 |

| Inventory Turnover Ratio | Efficiency of inventory management | Cost of Goods Sold / Average Inventory | 4.5 | 5.0 |

| Leverage Ratios | ||||

| Debt-to-Equity Ratio | Degree of financial leverage | Total Liabilities / Shareholder’s Equity | 0.8 | 0.7 |

| Interest Coverage Ratio | Ability to cover interest expenses | EBIT (Earnings Before Interest and Taxes) / Interest Expenses | 3.0 | 3.5 |

See More : Tata Investment share price Target 2025 to 2050

Overview of Moschip share price

| Parameter | Value |

|---|---|

| Open | 192.00 |

| Previous Close | 189.40 |

| Volume | 423,995 |

| Value (Lacs) | 842.27 |

| VWAP | 196.79 |

| Beta | 1.09 |

| Market Cap (Rs. Cr.) | 3,769 |

| High | 200.50 |

| Low | 192.00 |

| UC Limit | 218.50 |

| LC Limit | 178.80 |

| 52 Week High | 326.80 |

| 52 Week Low | 83.50 |

| Face Value | 2 |

| All Time High | 326.80 |

| All Time Low | 1.30 |

| 20D Avg Volume | 559,606 |

| 20D Avg Delivery (%) | 54.56 |

| Book Value Per Share | 15.54 |

| Dividend Yield | — |

Moschip Share Price Target 2025

| Starting Month | End Of Month | |

| January | 282 | 310 |

| February | 310 | 340 |

| March | 340 | 369 |

| April | 369 | 390 |

| May | 390 | 420 |

| June | 420 | 452 |

| July | 452 | 470 |

| August | 470 | 493 |

| September | 493 | 521 |

| October | 521 | 549 |

| November | 549 | 580 |

| December | 580 | 598 |

Moschip Share Price Target 2026

| Starting Month | End Of Month | |

| January | 598 | 628 |

| February | 628 | 644 |

| March | 644 | 660 |

| April | 660 | 685 |

| May | 685 | 710 |

| June | 710 | 736 |

| July | 736 | 755 |

| August | 755 | 778 |

| September | 778 | 796 |

| October | 796 | 819 |

| November | 819 | 842 |

| December | 842 | 870 |

Moschip Share Price Target 2026

| Starting Month | End Of Month | |

| January | 1070 | 1083 |

| February | 1083 | 1110 |

| March | 1110 | 1138 |

| April | 1138 | 1153 |

| May | 1153 | 1178 |

| June | 1178 | 1213 |

| July | 1213 | 1240 |

| August | 1240 | 1280 |

| September | 1280 | 1307 |

| October | 1307 | 1330 |

| November | 1330 | 1359 |

| December | 1359 | 1386 |

Moschip Share Price Target 2030

| Starting Month | End Of Month | |

| January | 1636 | 1660 |

| February | 1660 | 1689 |

| March | 1689 | 1712 |

| April | 1712 | 1737 |

| May | 1737 | 1758 |

| June | 1758 | 1769 |

| July | 1769 | 1796 |

| August | 1796 | 1827 |

| September | 1827 | 1851 |

| October | 1851 | 1870 |

| November | 1870 | 1894 |

| December | 1894 | 1930 |

Moschip Share Price Target 2035

| Starting Month | End Of Month | |

| January | 2182 | 2205 |

| February | 2205 | 2230 |

| March | 2230 | 2257 |

| April | 2257 | 2280 |

| May | 2280 | 2310 |

| June | 2310 | 2335 |

| July | 2335 | 2360 |

| August | 2360 | 2384 |

| September | 2384 | 2405 |

| October | 2405 | 2433 |

| November | 2433 | 2459 |

| December | 2459 | 2489 |

Peer comparison

- Oracle Fin.Serv.

- PB Fintech.

- Coforge

- Tata Elxsi

- KPIT Technologies

- Inventurus Knowl

- Tata Technologies

- Moschip Tech.

Advantages and Disadvantages Of NBCC Share Price

Advantages

- Quarterly financial results should be strong for a company.

- Since 2014, our Company has seen remarkable compounded annual profit growth of 18.6% CAGR over 5 years. Moschip share price target 2025 to 2030

- Company experienced median sales growth of 32.84% over 10 years.

Disadvantages

- At 12.9 times book value, this stock has seen significant trading volume.

- Though the company reports repeated profits, they do not plan to distribute dividends.

- Promoter Holding has declined by 0.45% year over quarter.

- Tax rate seems low This company had an overall low return on equity of 6.634% over its last 3 year history. Moschip share price target 2025 to 2030

- Companies could potentially reduce interest expense by capitalizing it.

Quarterly Results

| Period | Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales + | 38.02 | 38.29 | 37.41 | 41.67 | 49.15 | 53.70 | 53.83 | 57.01 | 71.85 | 89.63 | 75.42 | 80.35 | 125.63 |

| Expenses + | 32.27 | 32.09 | 31.68 | 35.58 | 43.90 | 46.18 | 46.38 | 49.28 | 61.63 | 80.83 | 68.05 | 71.49 | 109.89 |

| Operating Profit | 5.75 | 6.20 | 5.73 | 6.09 | 5.25 | 7.52 | 7.45 | 7.73 | 10.22 | 8.80 | 7.37 | 8.86 | 15.74 |

| OPM % | 15.12% | 16.19% | 15.32% | 14.61% | 10.68% | 14.00% | 13.84% | 13.56% | 14.22% | 9.82% | 9.77% | 11.03% | 12.53% |

| Other Income + | 1.22 | 1.29 | 0.57 | 0.95 | 3.24 | 0.62 | 0.16 | 1.66 | 0.84 | 0.41 | 0.58 | 1.50 | 1.01 |

| Interest | 2.20 | 2.11 | 2.10 | 2.04 | 2.45 | 1.71 | 1.52 | 1.55 | 1.53 | 1.48 | 1.46 | 1.62 | 1.93 |

| Depreciation | 3.16 | 3.26 | 3.19 | 3.45 | 4.74 | 4.57 | 4.57 | 4.53 | 5.57 | 5.26 | 4.90 | 4.63 | 5.09 |

| Profit Before Tax | 1.61 | 2.12 | 1.01 | 1.55 | 1.30 | 1.86 | 1.52 | 3.31 | 3.96 | 2.47 | 1.59 | 4.11 | 9.73 |

| Tax % | 0.62% | 0.00% | 0.00% | 0.00% | 4.62% | 0.00% | 0.00% | 3.02% | 8.59% | 11.34% | 45.28% | 2.92% | 0.00% |

| Net Profit + | 1.60 | 2.12 | 1.01 | 1.55 | 1.24 | 1.86 | 1.52 | 3.21 | 3.63 | 2.19 | 0.87 | 3.98 | 9.73 |

| EPS in Rs | 0.10 | 0.13 | 0.06 | 0.10 | 0.08 | 0.11 | 0.09 | 0.18 | 0.20 | 0.12 | 0.05 | 0.21 | 0.51 |

Profit & Loss

| Period | Mar 2013 | Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | TTM |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales + | 10 | 8 | 6 | 5 | 38 | 60 | 75 | 99 | 105 | 148 | 198 | 294 | 371 |

| Expenses + | 17 | 14 | 8 | 14 | 37 | 66 | 91 | 114 | 98 | 125 | 172 | 260 | 330 |

| Operating Profit | -7 | -7 | -2 | -9 | 0 | -5 | -16 | -15 | 7 | 23 | 26 | 34 | 41 |

| OPM % | -69% | -88% | -37% | -165% | 0% | -9% | -21% | -15% | 7% | 15% | 13% | 12% | 11% |

| Other Income + | -6 | -1 | 0 | 0 | 3 | 0 | 2 | -16 | 2 | 5 | 5 | 3 | 4 |

| Interest | 1 | 2 | 2 | 3 | 2 | 5 | 5 | 6 | 9 | 9 | 8 | 6 | 6 |

| Depreciation | 1 | 0 | 0 | 0 | 0 | 2 | 9 | 9 | 9 | 13 | 17 | 20 | 20 |

| Profit Before Tax | -14 | -10 | -5 | -12 | 1 | -13 | -28 | -46 | -9 | 6 | 6 | 11 | 18 |

| Tax % | 0% | 0% | 0% | 0% | 9% | 0% | 3% | -1% | 1% | 0% | 1% | 13% | |

| Net Profit + | -14 | -10 | -5 | -12 | 1 | -13 | -29 | -46 | -9 | 6 | 6 | 10 | 17 |

| EPS in Rs | -3.13 | -2.13 | -1.01 | -2.59 | 0.09 | -0.96 | -1.96 | -2.91 | -0.58 | 0.40 | 0.37 | 0.53 | 0.89 |

| Dividend Payout % | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

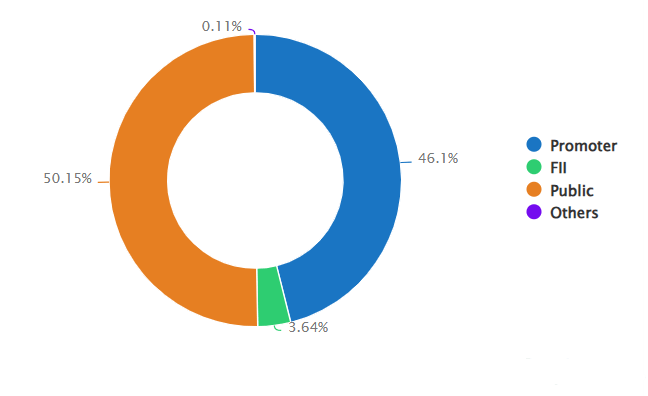

Shareholding Pattern

Recent data reveals the following ownership breakdown for the company: Promoters hold 46.10%, Foreign Institutional Investors (FIIs) own 3.64% and general public hold 500.15% with other shareholders having minimal stakes (0.10% or below).

| Shareholder Type | Percentage |

|---|---|

| Promoters | 46.10% |

| FIIs | 3.64% |

| Public | 50.15% |

| Others | 0.10% |

Moschip Plans to Launch Plans Over Next 5 Years

Moschip Technologies, an industry-leading semiconductor firm, is creating detailed plans to foster its growth and innovation over the next five years. Here are its main points:

Product Diversification: Moschip will focus on developing innovative semiconductor technologies and solutions suitable for various industries including automotive, IoT and smart devices. Moschip share price target 2025 to 2030

Geographic Expansion: To expand their presence across international markets and consolidate existing ones. The company plans on entering new regions.

Technical Partnerships: Moschip will foster partnerships and collaborations in order to develop the next-generation technological solutions.

Research and Development: By prioritizing investments in innovation, the company plans on intensifying R&D efforts in order to bring innovative products into the marketplace.

Sustainability and Environmental Commitment: Moschip will increase its focus on sustainable development and green technologies to minimize its environmental footprint during manufacturing processes. Moschip share price target 2025 to 2030

conclusion

Moschip Technologies sees five years as an opportunity for innovation and expansion. Their plans, which include product diversification, geographical expansion, technical partnerships and investing more into research and development could make them strong competitors on the market. Moschip share price target 2025 to 2030

Moschip stands out as an environmental sustainability company by emphasizing green technological solutions and being socially responsible. Based on these factors, its share price may experience positive growth by 2025 if successful plans are implemented while managing any uncertainties present in global markets.

FAQs

Is Moschip a good buy?

Moschip Technologies Ltd stock has an intrinsic value of 58.25 INR under its Base Case scenario; when compared with its current market price of 196.8 INR this indicates an overvaluation by 70%. Moschip share price target 2025 to 2030

What is the future of Moschip?

MosChip Technologies’ current ratio has remained relatively constant over time, reaching 1.71 in 2024 compared to 0.63 in 2020. This indicates that Moschip Technologies possesses sufficient liquid assets to cover short-term obligations and thus offers an attractive low-risk investment opportunity. Moschip share price target 2025 to 2030

Can we buy moschip Share?

Purchase Moschip Technologies Ltd shares through ICICIdirect’s registered brokerage. Through this platform you can place orders to purchase these shares of Moschip Technologies Limited. Moschip share price target 2025 to 2030

What is the performance of MosChip?

Over the last three years, our company has witnessed impressive income growth of 38.19% and boasts an effective cash conversion ratio of 402.79.

Moschip share price target 2025 to 2030 Moschip share price target 2025 to 2030 Moschip share price target 2025 to 2030 Moschip share price target 2025 to 2030 Moschip share price target 2025 to 2030 Moschip share price target 2025 to 2030 Moschip share price target 2025 to 2030 Moschip share price target 2025 to 2030

One thought on “Moschip share price target 2025 to 2030”