Cochin Shipyard share price target 2025 to 2050 : The primary work of our company entails building, fixing and upgrading ships used by military, aircraft carriers and patrol boats. Cochin Shipyard share price target 2025 to 2050

What is Cochin Shipyard Ltd (CSL)?

Cochin Shipyard Limited of India specialises in ship construction and repairs.

This company builds all types of ships as well as providing repairs, upgrades, maintenance services and life extension for them. They specialize in aircraft carriers as well as tankers cargo ships and specialized vessels such as aircraft carrier repair.

Overview of cochin shipyard share

| Parameter | Value |

|---|---|

| Open | 1,369.95 |

| Previous Close | 1,359.55 |

| Volume | 385,406 |

| Value (Lacs) | 5,501.67 |

| VWAP | 1,401.23 |

| Beta | 1.29 |

| Market Cap (Rs. Cr.) | 37,554 |

| High | 1,427.50 |

| Low | 1,357.05 |

| UC Limit | 1,427.50 |

| LC Limit | 1,291.60 |

| 52 Week High | 2,979.45 |

| 52 Week Low | 713.35 |

| Face Value | 5 |

| All Time High | 2,979.45 |

| All Time Low | 104.55 |

| 20D Avg Volume | 1,872,806 |

| 20D Avg Delivery (%) | — |

| Book Value Per Share | 200.53 |

| Dividend Yield | 0.68 |

See More : Sarveshwar foods share price Target 2025 to 2050

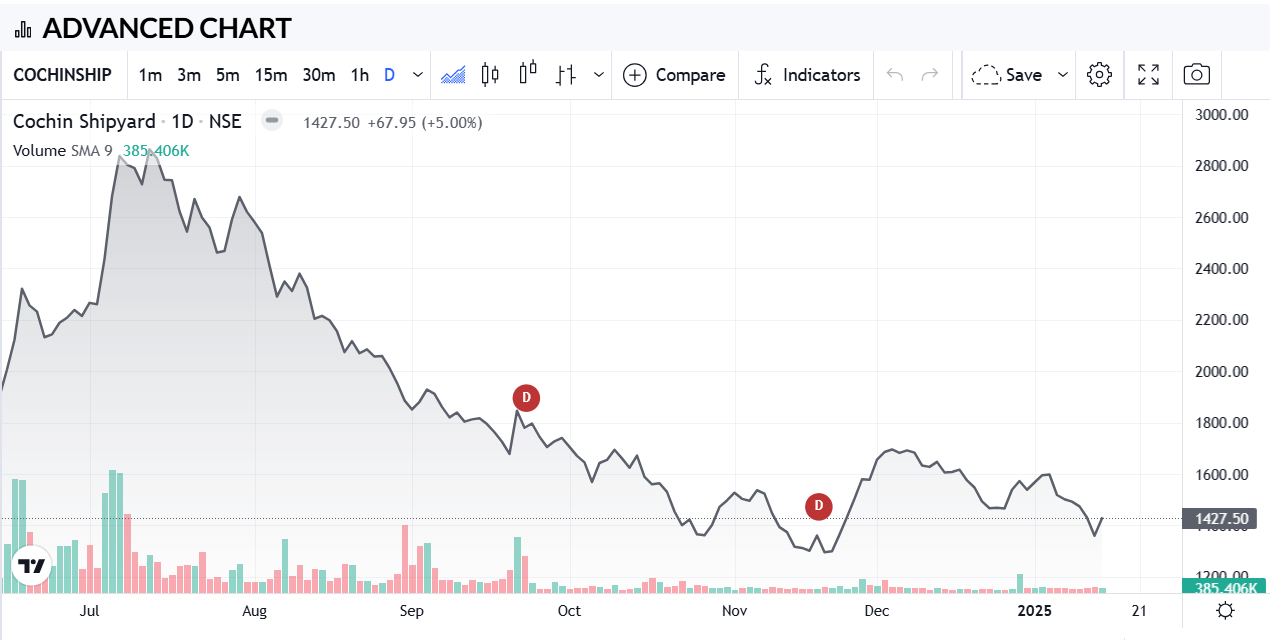

Cochin shipyard share graph

Cochin Shipyard Share Price Target 2024

From 2023, many Indian stocks including COCHINSHIP have experienced positive trends that should continue in 2024. Cochin Shipyard shares have experienced rapid appreciation since 2022; investors who purchase them could experience substantial returns if this trend holds on. Cochin Shipyard share price target 2025 to 2050

| Year | Minimum Price | Maximum Price |

| 2024 | 625 | 3700 |

| Month (2024) | Minimum Price | Maximum Price |

| January | ₹625 | ₹930 |

| February | ₹830 | ₹953 |

| March | ₹700 | ₹970 |

| April | ₹940 | ₹1350 |

| May | ₹1290 | ₹2000 |

| June | ₹1600 | ₹2300 |

| July | ₹2220 | ₹2935 |

| August | ₹2352 | ₹3058 |

| September | ₹2256 | ₹3157 |

| October | ₹2528 | ₹3458 |

| November | ₹2584 | ₹3355 |

| December | ₹2644 | ₹3700 |

Cochin Shipyard Share Price Target 2025

Cochin Shipyard Limited works both with private companies and with government. Since they started cooperating, their profits and project load both increased significantly; Cochin Shipyard builds both ships and shipyards and their share price has continued its rapid climb since 2022; investors may expect significant returns by 2025!

| Year | Minimum Price | Maximum Price |

| 2025 | 2645 | 5100 |

| Month (2025) | Minimum Price | Maximum Price |

| January | ₹2645 | ₹3545 |

| February | ₹2755 | ₹3352 |

| March | ₹2853 | ₹3587 |

| April | ₹2755 | ₹3755 |

| May | ₹2985 | ₹3622 |

| June | ₹3152 | ₹3745 |

| July | ₹3255 | ₹3844 |

| August | ₹3344 | ₹4055 |

| September | ₹3457 | ₹4255 |

| October | ₹3564 | ₹4572 |

| November | ₹3775 | ₹4825 |

| December | ₹3965 | ₹5100 |

Cochin Shipyard Share Price Target 2030

Cochin Shipyard receives investments from both India’s federal government and state government as it grows, being one of the oldest and top companies with strong cash flows and marketing potential, helping it further its expansion. Doing business both domestically and overseas helps build good partnerships while its stock price moves in an upward spiral – it makes Cochin Shipyard one of India’s best performers on both levels!

| Year | Minimum Price | Maximum Price |

| 2030 | 10500 | 15300 |

| Month (2030) | Minimum Price | Maximum Price |

| January | ₹10500 | ₹11520 |

| February | ₹11050 | ₹11852 |

| March | ₹11552 | ₹12755 |

| April | ₹11575 | ₹13500 |

| May | ₹10555 | ₹12470 |

| June | ₹11985 | ₹14520 |

| July | ₹12752 | ₹13852 |

| August | ₹13155 | ₹13752 |

| September | ₹13055 | ₹14552 |

| October | ₹13458 | ₹14952 |

| November | ₹13922 | ₹15100 |

| December | ₹14320 | ₹15300 |

Cochin Shipyard Share Price Target 2040

The company enjoys strong financials and past performance that have set it up well to capitalize on an increasing shipbuilding/repair demand.

Cochin Shipyard, owned and backed by the Government of India, can benefit greatly from their ownership. Overall, however, Cochin Shipyard remains an attractive investment option that investors should keep an eye on while being mindful of potential risks involved.

| Year | Minimum Price | Maximum Price |

| 2040 | ₹28500 | ₹32400 |

Cochin Shipyard Share Price Target 2050

Since their launch on NSE, this share has enjoyed unexpected profits since being put up for trading. If you look at its chart on NSE, the price has steadily gone in an upwards direction since this time due to huge government orders as well as export products into foreign countries. Their upward trajectory should continue due to India’s desire to keep up their defense force at all times. Cochin Shipyard share price target 2025 to 2050

| Year | Minimum Price | Maximum Price |

| 2050 | ₹44000 | ₹49500 |

Cochin Shipyard Share Price Target 2025 to 2050

Price range projections for 2050 include as follows: in 2024, minimum prices should reach Rs625, with maximums reaching Rs3,700; 2025 should see prices between 2,645 to 5,100 and by 2030 minimum prices could hit 10500 maximum 15300; by 2040 range is forecast between 28500-32400 while 2050 would see between 44,000-49,500

| Year | Minimum Price | Maximum Price |

| 2024 | ₹625 | ₹3700 |

| 2025 | ₹2645 | ₹5100 |

| 2030 | ₹10500 | ₹15300 |

| 2040 | ₹28500 | ₹32400 |

| 2050 | ₹44000 | ₹49500 |

This company has constructed an expansive and high-tech shipyard. They also repair and maintain ships. This company has demonstrated strong performance as evidenced by their share price graph, showing positive returns over the course of its operations. Given India’s military needs to remain up to date and stronger, you could consider taking a chance with this stock as it has demonstrated excellent past performances; just remember the stock market risk! Cochin Shipyard share price target 2025 to 2050

Advantages and Disadvantages Of Cochin Shipyard Share Price

Advantages

- Your company is almost debt free.

- Company should deliver high performance in this quarter.

- Company has consistently enjoyed an attractive dividend payout rate of 45.3% over time. Cochin Shipyard share price target 2025 to 2050

- Debtor days have decreased from 45.1 days to 33.5.

Disadvantages

- Since 2010, this company has witnessed only modest sales growth at 4.21 % annually.

- Over the last three years, our Company had an extremely low return on equity of 12.7%.

Quarterly – Cochin Shipyard Q4 Results

| Quarter | Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales (+) | 696 | 953 | 1,211 | 440 | 683 | 631 | 577 | 444 | 954 | 1,021 | 1,225 | 710 | 1,097 |

| Expenses (+) | 530 | 811 | 912 | 406 | 543 | 477 | 643 | 362 | 759 | 710 | 939 | 527 | 901 |

| Operating Profit | 166 | 142 | 299 | 34 | 139 | 154 | -66 | 82 | 195 | 311 | 286 | 182 | 196 |

| OPM % | 24% | 15% | 25% | 8% | 20% | 24% | -11% | 18% | 20% | 30% | 23% | 26% | 18% |

| Other Income (+) | 42 | 64 | 113 | 57 | 61 | 23 | 131 | 84 | 88 | 56 | 79 | 80 | 100 |

| Interest | 12 | 12 | 12 | 12 | 12 | 12 | -2 | 8 | 9 | 8 | 6 | 6 | 9 |

| Depreciation | 14 | 14 | 14 | 14 | 15 | 14 | 9 | 13 | 15 | 15 | 14 | 14 | 21 |

| Profit before Tax | 183 | 181 | 386 | 65 | 174 | 151 | 58 | 145 | 258 | 345 | 345 | 242 | 266 |

| Tax % | 26% | 26% | 26% | 25% | 31% | 21% | 19% | 25% | 26% | 28% | 23% | 25% | 28% |

| Net Profit (+) | 136 | 134 | 284 | 49 | 120 | 118 | 47 | 109 | 191 | 248 | 265 | 181 | 193 |

| EPS in Rs | 5.16 | 5.11 | 10.80 | 1.86 | 4.55 | 4.50 | 1.80 | 4.16 | 7.26 | 9.43 | 10.06 | 6.87 | 7.34 |

Profit & Loss

| Year | Mar 2013 | Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | TTM |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales (+) | 1,680 | 1,798 | 1,583 | 1,990 | 2,059 | 2,355 | 2,966 | 3,422 | 2,819 | 3,190 | 2,330 | 3,645 | 4,054 |

| Expenses (+) | 1,327 | 1,381 | 1,493 | 1,598 | 1,669 | 1,890 | 2,392 | 2,708 | 2,092 | 2,555 | 2,057 | 2,760 | 3,078 |

| Operating Profit | 353 | 417 | 90 | 393 | 390 | 465 | 574 | 714 | 727 | 635 | 273 | 885 | 976 |

| OPM % | 21% | 23% | 6% | 20% | 19% | 20% | 19% | 21% | 26% | 20% | 12% | 24% | 24% |

| Other Income (+) | 87 | 61 | 77 | 107 | 154 | 189 | 227 | 247 | 194 | 266 | 268 | 307 | 316 |

| Interest | 23 | 20 | 19 | 12 | 12 | 12 | 15 | 50 | 57 | 53 | 42 | 42 | 29 |

| Depreciation | 19 | 25 | 38 | 37 | 39 | 38 | 34 | 49 | 53 | 54 | 51 | 57 | 64 |

| Profit before Tax | 397 | 433 | 110 | 450 | 493 | 605 | 751 | 863 | 811 | 794 | 448 | 1,094 | 1,199 |

| Tax % | 33% | 35% | 37% | 35% | 35% | 34% | 36% | 26% | 25% | 26% | 25% | 26% | |

| Net Profit (+) | 266 | 282 | 69 | 292 | 322 | 397 | 481 | 638 | 610 | 587 | 334 | 813 | 887 |

| EPS in Rs | 11.75 | 12.43 | 3.06 | 12.88 | 14.19 | 14.59 | 18.29 | 24.24 | 23.19 | 22.29 | 12.71 | 30.91 | 33.70 |

| Dividend Payout % | 6% | 6% | 25% | 30% | 32% | 41% | 36% | 34% | 33% | 38% | 67% | 32% |

Shareholding Pattern of Cochin Shipyard Share

As per recent data, shareholder distribution in terms of shareholder distribution looks like this: Promoters own 72.86% of the shares, representing the largest portion. Foreign Institutional Investors (FIIs) own 3.84%, while Domestic Institutional Investors (DIIs) hold 3.00%; leaving only 20.31% owned by the public.

| Shareholder Type | Percentage |

|---|---|

| Promoters | 72.86% |

| FIIs | 3.84% |

| DIIs | 3.00% |

| Public | 20.31% |

Peer Comperision

- Cochin Shipyard

- Mazagon Dock

- Garden Reach Sh

- Laxmipati Eng.

- VMS Industries

Points to be considered before in Cochin Shipyard Ltd:-

Return on investment should exceed amount invested and investor should feel content with investment return as a whole. Cochin Shipyard share price target 2025 to 2050

Before investing, one should determine their available funds, the type of fund to invest in and its returns as well as availability must all be assessed.

Read through and analyze both the financial ratios and statements for any company before engaging with its share exchange listing. Compare them against similar ones!

Prior to investing, all risk factors associated with the company should be carefully evaluated as any oversight could prove costly in the future. Ignorance of these small details may result in severe consequences down the line.

Before investing, one should carefully study and take note of a company’s dividend policies and tax implications as these can change from quarter to quarter and at year’s end.

Discuss investment plans with your financial adviser before making your decisions, avoiding loans for this purpose; invest a manageable sum according to your capabilities and take into consideration trends regarding profits and dividends of your company.

Conclusion

So we have provided all the in-depth details regarding this share to assist in making an informed decision as to whether it should be invested in or not. Furthermore, we’ve shared information regarding their quarterly result – both good or bad news so please read up before investing! Cochin Shipyard share price target 2025 to 2050

Cochin Shipyard share price target 2025 to 2050 Cochin Shipyard share price target 2025 to 2050 Cochin Shipyard share price target 2025 to 2050 Cochin Shipyard share price target 2025 to 2050 Cochin Shipyard share price target 2025 to 2050 Cochin Shipyard share price target 2025 to 2050 Cochin Shipyard share price target 2025 to 2050 Cochin Shipyard share price target 2025 to 2050