CDSL share price target 2025 to 2050 : Exploring CDSL share price targets from 2025-2050 using market trends, historical performances, balance sheet analysis, profit and loss report evaluation and more. Central Depository Services (India) Limited (CDSL) is an Indian company that specializes in depository services, data processing services and related activities. CDSL share price target 2025 to 2050

Our operations focus on three core services, Depository Services, Data Entry and Storage Services and Repository Services. CDSL share price target 2025 to 2050

CDSL provides investors with an array of depository services, such as dematerialization, rematerialization, secure holding, transfer and pledge of securities in electronic form. Furthermore, they offer corporate e-voting solutions.

Data Entry and Storage Services provide centralized record-keeping of Know Your Customer (KYC) documents for capital market investors.

The Repository segment serves policyholders and warehouse receipt holders by offering them the convenience of keeping insurance policies and warehouse receipts electronically, with changes, modifications, or revisions occurring easily within this segment.

CDSL provides various digital services including an e-Locker, Myeasi Mobile App, M-Voting, e-Voting, SMART voting and electronic access to securities information for secure transactions. CDSL share price target 2025 to 2050

Established in 1997, CDSL is led by its Managing Director, Mr. Nehal Vora.

What is cdsl ( CDSL share price target 2025 to 2050 )

Central Depository Services (India) Limited was established in 1999 and since then has grown into an important player in Indian banking sector by offering various depository services to investors. CDSL allows for easier transaction processing and record keeping via its electronic holdings of assets; investors may take advantage of electronic holdings of assets through CDSL to maintain electronic asset holdings with them for smoother transactions and record keeping. There are three divisions within CDSL: Operations Division, Asset Division and Investor Services. CDSL share price target 2025 to 2050

Depository organizations provide services including the safekeeping of securities, assistance with dematerialization/rematerialization processes, and more.

Keep customer records for investors in financial markets up-to-date.

Electronic policy and warehouse receipt maintenance are among the services provided by this repository. CDSL share price target 2025 to 2050

CDSL is one of India’s premier depositories, holding 58% market share. Their online account creation feature makes investing easier for individual investors who wish to enter the stock market – something which bodes well for company development.

See More : Trent share price target 2025 to 2050

Company Profile

| Metric | Value |

|---|---|

| Company Type | Public |

| Traded As | NSE: CDSL |

| ISIN | INE736A01011 |

| Industry | Depository services |

| Founded | February 1999 |

| Headquarters | Mumbai, India |

| Key People | Nehal Vora (Managing Director & CEO) |

| Services | Dematerialisation of securities, Transfer and settlement of securities |

| Website | www.cdslindia.com |

Recent Graph of CDSL

Are CDSL Demat Accounts different?

Imagine this scenario – no account with CDSL but one of your brokers has suddenly taken away your shares? Luckily, CDSL keeps all transaction records of accounts so they can buy or sell shares through any broker without worry! CDSL share price target 2025 to 2050

Market overview

| Metric | Value |

|---|---|

| Open | 1,607.70 |

| Previous Close | 1,597.90 |

| Volume | 1,110,438 |

| Value (Lacs) | 17,739.80 |

| VWAP | 1,602.27 |

| Beta | 1.15 |

| Market Cap (Rs. Cr.) | 33,388 |

| High | 1,619.35 |

| Low | 1,591.30 |

| UC Limit | 1,757.65 |

| LC Limit | 1,438.15 |

| 52 Week High | 1,989.80 |

| 52 Week Low | 811.00 |

| Face Value | 10 |

| All Time High | 1,989.80 |

| All Time Low | 89.90 |

| 20D Avg Volume | 3,638,511 |

| 20D Avg Delivery (%) | 21.52 |

| Book Value Per Share | 73.16 |

| Dividend Yield | 1.38% |

| TTM EPS | 25.50 (+51.00% YoY) |

| TTM PE | 62.65 (Low PE) |

| P/B | 21.84 (Average P/B) |

| Sector PE | – |

CDSL Share Price Target 2024

CDSL shares are projected to trade within an anticipated range of Rs900 and Rs2,900 by 2024 due to increased market share and demat account openings, supporting this expectation. Target of Rs900 targets retail growth while target of Rs1,900 targets operational improvements and revenue diversification.

| Year | Minimum Price | Maximum Price |

| 2024 | ₹900 | ₹1,900 |

| Month | Minimum Price | Maximum Price |

| January | ₹908 | ₹1,050 |

| February | ₹930 | ₹1,170 |

| March | ₹950 | ₹1,100 |

| April | ₹1,060 | ₹1,210 |

| May | ₹1,080 | ₹1,130 |

| June | ₹1,100 | ₹1,250 |

| July | ₹1,120 | ₹1,380 |

| August | ₹1,240 | ₹1,500 |

| September | ₹1,360 | ₹1,650 |

| October | ₹1,380 | ₹1,550 |

| November | ₹1,440 | ₹1,720 |

| December | ₹1,350 | ₹1,900 |

CDSL Share Price Target 2025

Experts expect CDSL share prices to range between Rs1,660 and Rs2,915, due to its success with subsidiary services like KYC registration and insurance dematerialization which have driven expansion. CDSL’s income should increase as these services gain popularity thus further solidifying its market standing and strengthening CDSL’s market presence.

| Year | Minimum Price | Maximum Price |

| 2025 | ₹1,660 | ₹2,915 |

| Month | Minimum Price | Maximum Price |

| January | ₹1,660 | ₹2050 |

| February | ₹1655 | ₹2000 |

| March | ₹1625 | ₹2100 |

| April | ₹1662 | ₹2122 |

| May | ₹1752 | ₹2227 |

| June | ₹1750 | ₹2357 |

| July | ₹1624 | ₹2458 |

| August | ₹1752 | ₹2385 |

| September | ₹1885 | ₹2585 |

| October | ₹1886 | ₹2622 |

| November | ₹1945 | ₹2752 |

| December | ₹1932 | ₹2915 |

CDSL Share Price Target 2030

CDSL shares are projected to appreciate significantly by 2030, with estimates ranging from Rs7520 to Rs9142 being given as long-term growth projections based on its strong business strategy, digitization efforts in financial services and Indian stock market development. As more investors utilize electronic trading methods CDSL will enjoy success.

| Year | Minimum Price | Maximum Price |

| 2030 | ₹7520 | ₹9142 |

| Month | Minimum Price | Maximum Price |

| January | ₹7520 | ₹7824 |

| February | ₹7625 | ₹8040 |

| March | ₹7752 | ₹7982 |

| April | ₹7852 | ₹8122 |

| May | ₹8055 | ₹8244 |

| June | ₹8075 | ₹8425 |

| July | ₹8122 | ₹8553 |

| August | ₹8175 | ₹8544 |

| September | ₹8541 | ₹8725 |

| October | ₹8604 | ₹8925 |

| November | ₹8695 | ₹9052 |

| December | ₹8825 | ₹9142 |

Share Price Target 2040

CDSL shares are expected to range between Rs13,000 and Rs15,000. This optimistic prediction is based on CDSL’s projected growth potential as it expands and adopts digital financial services. CDSL share price target 2025 to 2050

| Year | Minimum Price | Maximum Price |

| 2040 | ₹13,000 | ₹15,000 |

| Month | Minimum Price | Maximum Price |

| January | ₹13,000 | ₹13,500 |

| February | ₹13,200 | ₹13,700 |

| March | ₹13,400 | ₹13,900 |

| April | ₹13,600 | ₹14,100 |

| May | ₹13,800 | ₹14,300 |

| June | ₹14,000 | ₹14,500 |

| July | ₹14,200 | ₹14,700 |

| August | ₹14,400 | ₹14,900 |

| September | ₹14,600 | ₹15,000 |

| October | ₹14,800 | ₹15,200 |

| November | ₹15,000 | ₹15,500 |

| December | ₹15,200 | ₹15,800 |

Share Price Target 2050

CDSL shares are projected to trade between Rs22,000 and Rs25,000 by 2050, taking into account CDSL’s strategic goals of expanding its service portfolio and market position while taking into account India’s economy and financial services sector’s projected expansion.

| Year | Minimum Price | Maximum Price |

| 2050 | ₹22,000 | ₹25,000 |

| Month | Minimum Price | Maximum Price |

| January | ₹22,000 | ₹23,000 |

| February | ₹22,500 | ₹23,500 |

| March | ₹23,000 | ₹24,000 |

| April | ₹23,500 | ₹24,500 |

| May | ₹24,000 | ₹25,000 |

| June | ₹24,500 | ₹25,500 |

| July | ₹25,000 | ₹26,000 |

| August | ₹25,500 | ₹26,500 |

| September | ₹26,000 | ₹27,000 |

| October | ₹26,500 | ₹27,500 |

| November | ₹27,000 | ₹28,000 |

| December | ₹27,500 | ₹28,500 |

Share Price Target 2024 to 2050

| Year | Minimum Price | Maximum Price |

| 2024 | ₹900 | ₹1,900 |

| 2025 | ₹1,660 | ₹2,915 |

| 2030 | ₹7520 | ₹9,142 |

| 2040 | ₹13,000 | ₹15,000 |

| 2050 | ₹22,000 | ₹25,000 |

CDSL (Central Depository Services (India) Ltd) stock purchase decisions are dependent on multiple criteria. CDSL dominates the Indian depository services industry with 58% market share and ongoing profitability from various income sources, which has contributed to continuous profitability growth over time. Some key positive attributes for CDSL include their large market share, rising number of retail investors, growth into KYC/insurance dematerialization services and dematerialization, strong digital transformation emphasis, as well as sustained profitability growth over time.

Bearish considerations related to CDSL include fierce competition from NSDL and fintech businesses, regulatory concerns, economic volatility affecting trade volumes, cybersecurity threats and market reliance. Analysts forecast CDSL share prices will rise between Rs1,708 – Rs2,950 by 2024-2025 with significant growth potential; their estimated prices of between Rs2,500-3.915. However, investors should carefully weigh both optimistic and bearish variables when making investment decisions based on their personal financial goals and risk tolerance. CDSL share price target 2025 to 2050

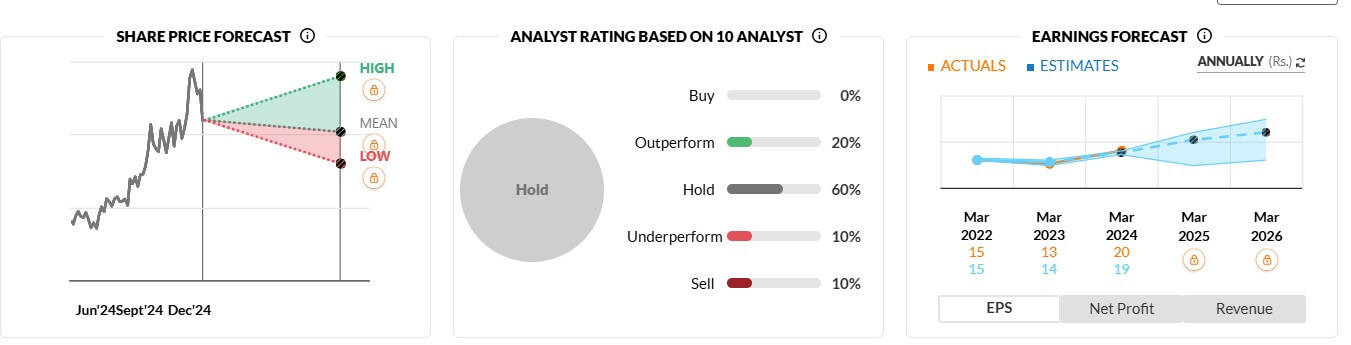

Forecast

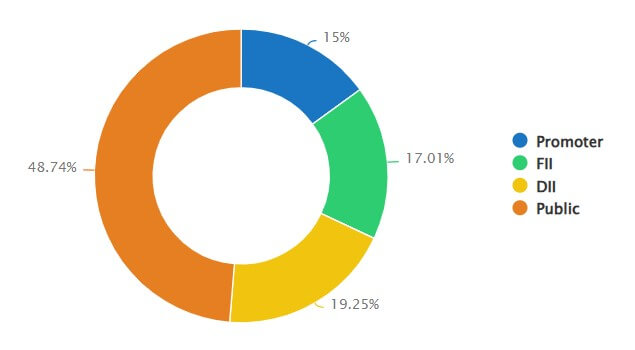

CDSL Shareholding Pattern

| Shareholder Category | Percentage |

|---|---|

| Promoters | 15.00% |

| FIIs (Foreign Inst.) | 17.15% |

| DIIs (Domestic Inst.) | 19.11% |

| Public | 48.74% |

| No. of Shareholders | 11,73,419 |

CDSL Peer Companies

- BSE

- CDSL

- Multi Comm. Exc.

- Cams Services

- KFin Technologies

- Indian Energy Ex.

Points to be considered before investing in Central Depositary Services Limited (CDSL):-

- Be mindful to closely track the share price range of any company as this can fluctuate at any moment in time. CDSL share price target 2025 to 2050

- Before investing, individuals must evaluate all risk factors carefully and keep track of them; failing to do so could result in substantial financial loss for themselves and others. CDSL share price target 2025 to 2050

- Your financial adviser must help determine an investment amount and it should not change easily, except as necessary. CDSL share price target 2025 to 2050

- Financial statements, statements of profit and losses, ratio analysis should all be checked against credible sources to ascertain any fluctuations or patterns related to profits and dividends. CDSL share price target 2025 to 2050

- Prioritise tax liabilities on shares by keeping tabs of what percentage they involve and making necessary arrangements accordingly. CDSL share price target 2025 to 2050

CDSL Share Price Target Advantage and Disadvantage

Advantage

- Company debt has been greatly reduced. And they’re close to debt free!

- Quarterly results should be promising from this company.

- Over the past five years, our Company has achieved impressive compound annual profit growth of 29.9% compound annual rate.

- Company boasts an excellent return on equity (ROE) track record: Three Year ROE 28.9% CDSL share price target 2025 to 2050

- Company has consistently delivered a healthy dividend payout of 55.3% since inception. CDSL share price target 2025 to 2050

- Over the last 10 years, their median sales growth is 18.5%.

Disadvantage

- Stock is currently trading at 21.8 times its book value.

- Promoter Holding Level Is Low: 15.0%.

- Promoter holding has declined significantly over the last three years: -5.00%.

Central Depository Services Ltd (CDSL) Features

CDSL contains some invaluable features that may prove essential to people, including:

Dematerialization: Dematerialization refers to converting shares held in paper form into electronic form and posting them online so they are easily searchable, retrievable, and viewable in your Demat Account at all times. CDSL share price target 2025 to 2050

Different Types of Account: CDSL Company offers you various account types that meet your personal needs, such as an Instance, Individual or Retail Investor Demat Account.

CDSL provides security by keeping all assets stored electronically with Demat on the internet and only you are allowed to withdraw them, giving CDSL the responsibility of safeguarding all investments, transactions and credential information securely stored with them. CDSL share price target 2025 to 2050

Transaction Ease: CDSL takes on the responsibility of safely moving any assets stored in your demat account from one place to the other in an easy and safe fashion. They use OTP verification on the mobile number associated with their account holder’s mobile phone to help transfer these assets, thus offering excellent service.

Corporate Actions: If a company needs to take any kind of corporate action on assets that reside within its Demat account – for instance distributing dividends as payment for holding their shares, CDSL provides the perfect service in helping make that transfer.

Central Depository Services (India) Ltd Earnings Results

| Metric | Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales (in Rs Cr.) | 146 | 152 | 137 | 140 | 149 | 141 | 125 | 150 | 207 | 214 | 241 | 257 | 322 |

| Expenses (in Rs Cr.) | 47 | 49 | 46 | 66 | 58 | 57 | 56 | 70 | 79 | 84 | 93 | 103 | 122 |

| Operating Profit (in Rs Cr.) | 99 | 103 | 90 | 75 | 91 | 85 | 68 | 80 | 128 | 130 | 148 | 154 | 200 |

| OPM % | 68% | 68% | 66% | 53% | 61% | 60% | 55% | 53% | 62% | 61% | 61% | 60% | 62% |

| Other Income (in Rs Cr.) | 19 | 11 | 11 | 6 | 21 | 20 | 19 | 24 | 23 | 21 | 29 | 30 | 37 |

| Interest (in Rs Cr.) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Depreciation (in Rs Cr.) | 3 | 3 | 4 | 4 | 5 | 5 | 5 | 6 | 6 | 7 | 8 | 10 | 12 |

| Profit before tax (in Rs Cr.) | 115 | 111 | 98 | 77 | 107 | 99 | 82 | 98 | 145 | 145 | 168 | 175 | 225 |

| Tax % | 25% | 25% | 20% | 25% | 25% | 25% | 23% | 25% | 25% | 26% | 23% | 23% | 28% |

| Net Profit (in Rs Cr.) | 86 | 84 | 78 | 58 | 80 | 75 | 63 | 74 | 109 | 107 | 129 | 134 | 162 |

| EPS in Rs | 4.11 | 4.01 | 3.72 | 2.76 | 3.85 | 3.57 | 3.02 | 3.52 | 5.21 | 5.14 | 6.18 | 6.42 | 7.75 |

Profit & Loss

| Metric | Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales (in Rs Cr.) | 146 | 152 | 137 | 140 | 149 | 141 | 125 | 150 | 207 | 214 | 241 | 257 | 322 |

| Expenses (in Rs Cr.) | 47 | 49 | 46 | 66 | 58 | 57 | 56 | 70 | 79 | 84 | 93 | 103 | 122 |

| Operating Profit (in Rs Cr.) | 99 | 103 | 90 | 75 | 91 | 85 | 68 | 80 | 128 | 130 | 148 | 154 | 200 |

| OPM % | 68% | 68% | 66% | 53% | 61% | 60% | 55% | 53% | 62% | 61% | 61% | 60% | 62% |

| Other Income (in Rs Cr.) | 19 | 11 | 11 | 6 | 21 | 20 | 19 | 24 | 23 | 21 | 29 | 30 | 37 |

| Interest (in Rs Cr.) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Depreciation (in Rs Cr.) | 3 | 3 | 4 | 4 | 5 | 5 | 5 | 6 | 6 | 7 | 8 | 10 | 12 |

| Profit before tax (in Rs Cr.) | 115 | 111 | 98 | 77 | 107 | 99 | 82 | 98 | 145 | 145 | 168 | 175 | 225 |

| Tax % | 25% | 25% | 20% | 25% | 25% | 25% | 23% | 25% | 25% | 26% | 23% | 23% | 28% |

| Net Profit (in Rs Cr.) | 86 | 84 | 78 | 58 | 80 | 75 | 63 | 74 | 109 | 107 | 129 | 134 | 162 |

| EPS in Rs | 4.11 | 4.01 | 3.72 | 2.76 | 3.85 | 3.57 | 3.02 | 3.52 | 5.21 | 5.14 | 6.18 | 6.42 | 7.75 |

Balance Sheet

| Metric | Mar 2013 | Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | TTM |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales (in Rs Cr.) | 91 | 89 | 105 | 123 | 146 | 188 | 196 | 225 | 344 | 551 | 555 | 812 | 1,035 |

| Expenses (in Rs Cr.) | 55 | 56 | 60 | 59 | 67 | 77 | 87 | 136 | 132 | 186 | 236 | 324 | 402 |

| Operating Profit (in Rs Cr.) | 36 | 33 | 45 | 64 | 79 | 110 | 109 | 89 | 212 | 365 | 319 | 488 | 633 |

| OPM % | 39% | 37% | 43% | 52% | 54% | 59% | 56% | 40% | 62% | 66% | 57% | 60% | 61% |

| Other Income (in Rs Cr.) | 33 | 35 | 23 | 72 | 41 | 38 | 49 | 59 | 57 | 55 | 66 | 95 | 117 |

| Interest (in Rs Cr.) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Depreciation (in Rs Cr.) | 3 | 5 | 6 | 4 | 4 | 7 | 10 | 12 | 9 | 11 | 19 | 27 | 37 |

| Profit before tax (in Rs Cr.) | 66 | 62 | 63 | 131 | 117 | 141 | 148 | 136 | 260 | 409 | 365 | 556 | 713 |

| Tax % | 23% | 21% | 31% | 31% | 26% | 27% | 23% | 22% | 22% | 24% | 24% | 25% | – |

| Net Profit (in Rs Cr.) | 51 | 50 | 43 | 91 | 87 | 104 | 115 | 107 | 201 | 312 | 276 | 420 | 533 |

| EPS in Rs | 2.44 | 2.36 | 2.09 | 4.35 | 4.10 | 4.94 | 5.43 | 5.08 | 9.59 | 14.89 | 13.20 | 20.05 | 25.49 |

| Dividend Payout % | 41% | 42% | 53% | 29% | 37% | 35% | 37% | 44% | 47% | 50% | 61% | 55% | – |

Conclusion

Central Depository Services (India) Ltd provides an attractive investment opportunity for those seeking to profit from India’s rapidly growing financial services industry. CDSL stands on strong foundations with expanding market share and diverse service portfolio, offering investors plenty of room for success. However, potential investors should be mindful of potential hazards before proceeding. CDSL share price target 2025 to 2050

CDSL share price target 2025 to 2050 CDSL share price target 2025 to 2050 CDSL share price target 2025 to 2050 CDSL share price target 2025 to 2050 CDSL share price target 2025 to 2050 CDSL share price target 2025 to 2050 CDSL share price target 2025 to 2050