Bandhan Bank Share Price Target 2025 to 2050 : Bandhan Bank stands out as an interesting player on India’s banking market by combining microfinance and commercial banking activities into one entity. Investors and market observers keep tabs on Bandhan’s share price trend with great interest. Bandhan Bank Share Price Target 2025 to 2050

This extensive study employs expert projections and growth variables to derive Bandhan Bank share price targets for 2024-2050. Bandhan Bank Share Price Target 2025 to 2050

What is Bandhan Bank

Chandra Shekhar Ghosh established Bandhan Bank as a microfinance organization in 2001 and expanded it into a commercial bank in 2015. Today, Bandhan Bank offers various services: Bandhan Bank Share Price Target 2025 to 2050

Retail Banking Services for Micro, Small and Medium Enterprise (MSME) Banking, Commercial Banking Services for North and Rife Indians (NRI Banking), Digital Banking Solutions. Bandhan Bank Share Price Target 2025 to 2050

Key facts about Bandhan Bank:

- Established: 2001 (as a microfinance institution); 2015 (as a commercial bank).

- Headquarters of Kolkata, West Bengal, India

- Chandra Shekhar Ghosh serves as MD and CEO.

- Number of branches as of 2024: Over 6,250.

- Number of Customers as of 2024 (over 3.26 Crore)

- Market Capitalisation of RIL as of January 202; Rs37,405 Crore

Fundamental Overview ( Bandhan Bank Share Price Target 2025 to 2050 )

| Metric | Value |

|---|---|

| Open | 150.06 |

| Previous Close | 150.28 |

| Volume | 5,828,892 |

| Value (Lacs) | 8,831.35 |

| VWAP | 150.02 |

| Beta | 1.40 |

| Market Cap (Rs. Cr.) | 24,407 |

| High | 151.90 |

| Low | 148.55 |

| UC Limit | 165.30 |

| LC Limit | 135.25 |

| 52 Week High | 232.65 |

| 52 Week Low | 137.00 |

| Face Value | 10 |

| All Time High | 741.80 |

| All Time Low | 137.00 |

| 20D Avg Volume | 11,309,801 |

| 20D Avg Delivery (%) | 28.07 |

| Book Value Per Share | 147.21 |

| Dividend Yield | 0.99 |

See More : SBI Share Price Target 2025 to 2050

Recent Graph of Bandhan Bank Share Price

Bandhan Bank Share Price Target 2025

Bandhan Bank, established with its license from RBI in 2014, has witnessed rapid expansion. Focused on under-penetrated markets across India by providing both micro banking and general banking services, it has seen remarkable success as it serves its customer base with both micro banking and general banking products and services. This success can be directly attributed to Bandhan’s focus on targeting underserved markets that is contributing to its extraordinary growth.

Bandhan Bank’s focus on rural areas has been a crucial element of its expansion, as more rural residents gain access to banking services through these regions. By being so prevalent there, Bandhan Bank is reaping substantial advantages thanks to its wide presence there. Bandhan Bank Share Price Target 2025 to 2050

As rural banking continues to expand, Bandhan Bank may follow suit by expanding in rural areas as well. Their share price target in 2025 could reach Rs180 and then Rs200 shortly thereafter. Bandhan Bank Share Price Target 2025 to 2050

| Year | Bandhan Bank Share Price Target 2025 |

|---|---|

| First Target 2025 | Rs 180 |

| Second Target 2025 | Rs 200 |

Bandhan Bank Share Price Target 2026

Bandhan Bank’s business model centers around retail loans; their focus lies on offering small loans at competitive interest rates to people in rural areas at attractive interest rates, thus minimizing risk associated with NPAs (Non-Performing Assets). Even if one or two people default on loans, these smaller amounts do not cause significant disruptions for Bandhan Bank in terms of NPAs (Non-Performing Assets).

Slowly but steadily, many banks are shifting towards retail loans as they are considered less risky compared to corporate loans. Bandhan Bank’s continued emphasis on retail loans has enabled its performance to significantly improve and the management is confident this trend will continue in the coming years.

Given Bandhan Bank’s impressive track record, their 2026 share price targets seem promising. Their initial target could reach Rs220 with another goal potentially reaching up to Rs240 – providing investors with potentially excellent returns.

| Year | Bandhan Bank Share Price Target 2026 |

|---|---|

| First Target 2026 | Rs 220 |

| Second Target 2026 | Rs 240 |

Bandhan Bank Share Price Target 2027

An effective Net Interest Margin (NIM) is key for the growth of any bank. Banks’ primary function is taking deposits at low interest rates and lending it out at higher rates to generate profits; as Bandhan Bank currently stands, their NIM stands at 8.5% which is considered quite healthy and strong. Bandhan Bank Share Price Target 2025 to 2050

Bandhan Bank’s margin may fluctuate slightly over time; however, when compared with other leading private-sector banks in India its net interest margin (NIM) stands out as relatively strong; hence it is often considered one of the most profitable banks.

Bandhan Bank could achieve fantastic returns if it can maintain this margin, with initial target prices for 2027 around Rs260 and subsequent ones around Rs290 – investors should consider holding onto their stock to achieve these returns.

| Year | Bandhan Bank Share Price Target 2027 |

|---|---|

| First Target 2027 | Rs 260 |

| Second Target 2027 | Rs 290 |

Bandhan Bank Share Price Target 2028

Bandhan Bank’s business reach has steadily been expanding as they establish themselves both rural and semi-urban areas across Assam and West Bengal, although their current focus lies primarily in these states; their management are developing plans to broaden this presence throughout India over the coming years.

Bandhan Bank currently boasts approximately 1,190 branches and 432 ATMs across its footprint, as well as 4,456 banking units for efficient customer services across various markets. Their management plans to continue growing their branch network to aid business expansion. Bandhan Bank Share Price Target 2025 to 2050

Bandhan Bank anticipates its branch network expanding and business expanding alongside it, so their 2028 Share Price Target should reach Rs320; once achieved they could set another target such as Rs350 as an intermediate goal.

| Year | Bandhan Bank Share Price Target 2028 |

|---|---|

| First Target 2028 | Rs 320 |

| Second Target 2028 | Rs 350 |

Bandhan Bank Share Price Target 2030

Bandhan Bank stands in an excellent position when measured over time, as evidenced by its CASA ratio which stands at over 45% and which has been maintained over a significant period. When compared with other private banks, Bandhan Bank stands out.

Over the next several years, CASA Bank’s management is prioritizing growing deposits by offering competitive interest rates to its customers. This strategy enables it to lend out these funds at higher interest rates for lending back out at greater profit, thus contributing to an annual rise in income. Bandhan Bank Share Price Target 2025 to 2050

Based on its long-term growth potential, Bandhan Bank’s Share Price Target for 2030 should offer significant returns for shareholders – with shares possibly reaching around Rs500 in value by then. Bandhan Bank Share Price Target 2025 to 2050

| Year | Bandhan Bank Share Price Target 2028 |

|---|---|

| First Target 2028 | Rs 560 |

| Second Target 2028 | Rs 764 |

Bandhan Bank Share Price Target 2040

Projecting share values until 2040 can be quite uncertain; however, given Bandhan Bank’s prominent standing within India’s banking market and economic development potential of India we can make some reasonable predictions.

| Year | Bandhan Bank Share Price Target 2028 |

|---|---|

| First Target 2028 | Rs 1,440 |

| Second Target 2028 | Rs 1,970 |

Bandhan Bank Share Price Target 2050

Predicting share prices in 2050 requires long term visioning rather than exact forecasting, although present patterns and long term economic predictions might provide valuable information that helps inform prospective situations.

| Year | Bandhan Bank Share Price Target 2028 |

|---|---|

| First Target 2028 | Rs 3,000 |

| Second Target 2028 | Rs 3,200 |

Future of Bandhan Bank Share

Bandhan Bank appears poised for long-term success due to its consistent efforts to diversify its loan portfolio and rapidly expand its branch network, both strategies that should lead to significant business expansion in due course.

Bandhan Bank stands to gain immensely from government’s strong backing of SME (Small and Medium Enterprises) development, as it stands to take advantage of more small businesses seeking loans in the future. By catering to this growing need for SME lending services, Bandhan Bank stands to become an even stronger contender within this space. As it continues to meet it, it may gain significant market share within this segment.

Risk of Bandhan Bank Share

Bandhan Bank faces its primary threat from retail loans, which pose difficulty when collecting. Recently there have been incidents related to this reliance, with tighter government regulation potentially impacting Bandhan Bank business negatively.

Additionally, many larger banks have begun targeting retail loans as lower-risk opportunities and this competition between banks could increase over the coming years, especially regarding interest rate competition – potentially forcing Bandhan Bank to lower its rates to remain competitive, leading to reduced profits overall.

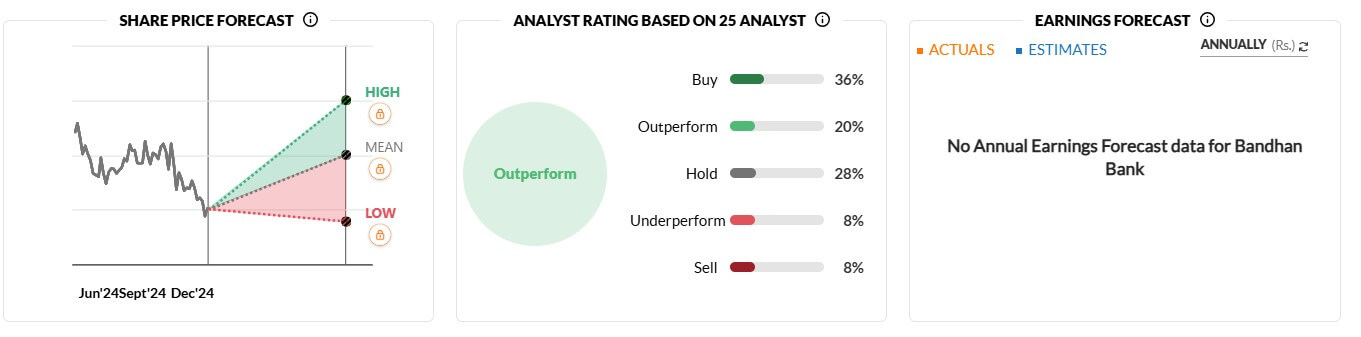

Forecast

Quarterly Results

| Metric | Mar 2024 | Jun 2024 | Sep 2024 |

|---|---|---|---|

| Revenue | 1,071 | 1,207 | 1,249 |

| Interest | 595 | 749 | 809 |

| Expenses | 498 | 515 | 562 |

| Financing Profit | -22 | -57 | -122 |

| Financing Margin % | -2% | -5% | -10% |

| Other Income | 75 | 153 | 161 |

| Depreciation | 21 | 25 | 0 |

| Profit before tax | 32 | 70 | 38 |

| Tax % | -56% | 18% | N/A |

| Net Profit | 49 | 58 | 24 |

| EPS in Rs | 1.25 | 1.46 | 0.61 |

| Gross NPA % | 3.84% | 4.23% | 4.68% |

| Net NPA % | 1.11% | 1.15% | 1.29% |

Profit & Loss

| Metric | Mar 2022 | Mar 2023 | Mar 2024 | TTM |

|---|---|---|---|---|

| Revenue | 13,872 | 15,905 | 18,870 | 20,890 |

| Interest | 5,157 | 6,645 | 8,544 | 9,545 |

| Expenses | 11,298 | 8,693 | 9,310 | 10,004 |

| Financing Profit | -2,584 | 567 | 1,016 | 1,341 |

| Financing Margin % | -19% | 4% | 5% | 6% |

| Other Income | 2,822 | 2,469 | 2,165 | 2,362 |

| Depreciation | 110 | 143 | 238 | 0 |

| Profit before tax | 129 | 2,893 | 2,943 | 3,702 |

| Tax % | 2% | 24% | 24% | |

| Net Profit | 126 | 2,195 | 2,230 | 2,788 |

| EPS in Rs | 0.78 | 13.62 | 13.84 | 17.31 |

| Dividend Payout % | 0% | 11% | 11% |

Balance Sheet

| Metric | Mar 2022 | Mar 2023 | Mar 2024 |

|---|---|---|---|

| Equity Capital | 1,611 | 1,611 | 1,611 |

| Reserves | 15,770 | 17,973 | 19,999 |

| Borrowings | 116,252 | 132,776 | 151,574 |

| Other Liabilities | 5,362 | 3,677 | 4,659 |

| Total Liabilities | 138,995 | 156,037 | 177,842 |

| Fixed Assets | 415 | 509 | 959 |

| CWIP | 173 | 346 | 214 |

| Investments | 29,079 | 32,366 | 29,288 |

| Other Assets | 109,329 | 122,817 | 147,381 |

| Total Assets | 138,995 | 156,037 | 177,842 |

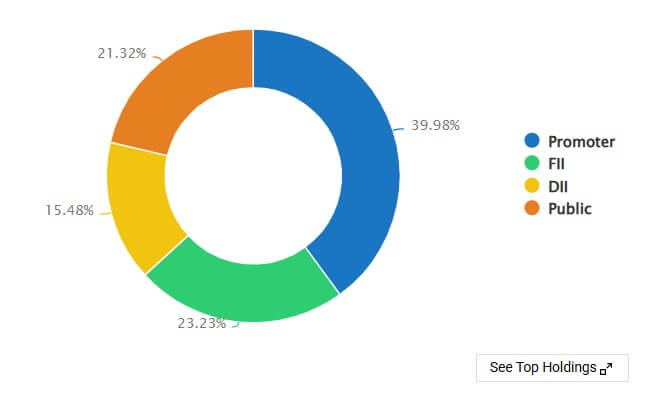

Shareholding Pattern

| Metric | Dec 2024 |

|---|---|

| Promoters + | 39.98% |

| FIIs + | 23.23% |

| DIIs + | 15.41% |

| Government + | 0.07% |

| Public + | 21.32% |

| No. of Shareholders | 8,61,228 |

Conclusion

Bandhan Bank stands out in India’s banking industry by virtue of its distinctive position, making it an exceptional opportunity for financial inclusion and rural bank development stories. Current share price expectations indicate cautious optimism regarding Bandhan’s potential growth due to portfolio diversification, digital transformation, and economic development initiatives across India. Bandhan Bank Share Price Target 2025 to 2050

Bandhan Bank Share Price Target 2025 to 2050 Bandhan Bank Share Price Target 2025 to 2050 Bandhan Bank Share Price Target 2025 to 2050 Bandhan Bank Share Price Target 2025 to 2050 Bandhan Bank Share Price Target 2025 to 2050 Bandhan Bank Share Price Target 2025 to 2050 Bandhan Bank Share Price Target 2025 to 2050

2 thoughts on “Bandhan Bank Share Price Target 2025 to 2050”