Jio Financial Share Price Target Tomorrow 2025 To 2030 : If you plan to buy shares of Jio Finance in the near future, it is imperative that you are informed about its stock price for the coming years. Therefore, here we present analysts’ projections regarding Jio Finance Share Price Target From 2025-2050.

Mukesh Ambani founded Jio Finance with Reliance Industries to establish it as an integral component of their digital sector. Their headquarters is situated in Mumbai, Maharashtra; their strong digital infrastructure provides superior services to their customers while protecting customer data through advanced security features as well as offering exceptional support systems to users.

Recent Graph of Jio Financial Share Price

Jio Financial Services Company Overview

Jio Finance, a subsidiary of Reliance Industries that works in India’s financial services, strives to foster digital financial revolution with payment gateways, insurance products and loans that customers can easily access. It offers payment services such as Pay U money to consumers. Jio Financial Share Price Target Tomorrow 2025 To 2030

Jio Finance provides digital money services such as bill payment, money transfer and online shopping that enable its customers to quickly send and transfer money within minutes. Furthermore, fast and secure transactions allow Jio Finance’s customers to do financial work from home quickly and safely – not forgetting personal loans with low rates of interest that you can apply for online – plus insurance services made convenient so they can take out policies anytime they’re necessary – providing more financial independence!

| Company Name | Jio Financial Services Ltd. |

| Founded | 1999 |

| Headquarters | Mumbai |

| Industry/Sector | Finance |

| Stock Exchange Listing | NSE & BSE |

| Official Website | jfs.in |

See More : IDFC First Bank Share Price Target 2025 to 2050

Jio Finance saw an overwhelming response upon its initial release and quickly implemented new services like digital gold, payments bank accounts and various types of loans for customers in rural and small town locations across India. Furthermore, this company collaborated with banks, insurers and financial institutions in providing superior service offerings to its users. Jio Financial Share Price Target Tomorrow 2025 To 2030

Jio Finance Share Price Fundamental Analysis

| Parameter | Value |

|---|---|

| Open | 256.00 |

| Previous Close | 255.85 |

| Volume | 38,379,153 |

| Value (Lacs) | 93,817.84 |

| VWAP | 248.04 |

| Beta | 1.19 |

| Market Cap (Rs. Cr.) | 155,306 |

| High | 257.35 |

| Low | 243.55 |

| UC Limit | 281.40 |

| LC Limit | 230.30 |

| 52 Week High | 394.70 |

| 52 Week Low | 240.00 |

| Face Value | 10 |

| All Time High | 394.70 |

| All Time Low | 202.80 |

| 20D Avg Volume | 15,191,620 |

| 20D Avg Delivery (%) | 62.49 |

| Book Value Per Share | 39.06 |

| Dividend Yield | — |

Jio Financial Services Ltd. Analysis Report

JIO Financial Services, an industry leader in India’s financial sector, offers investment solutions designed to meet diverse financial needs. Operating within stringent regulatory guidelines and meeting compliance in broking activities and clearing operations.

With only 2% of India’s population investing in financial assets and only 7% penetration for mutual funds, India is poised for tremendous growth potential in this industry. Factors such as increasing financial literacy, digitization and more investment avenues help boost market participation even further. Jio Financial Share Price Target Tomorrow 2025 To 2030

Evaluation of JIO Financial Services requires using key financial indicators like profitability, EPS growth, return on equity (ROE) and P/E ratio. These provide valuable insight into its financial health and stock valuation.

Investors can utilize JIO Financial Services’ current P/E ratio of 0.00 and P/B ratio of 7.00 to determine whether or not their stock is undervalued relative to its market price.

Jio Financial Services share price Target 2025

Our study indicates that Jio Financial Services may set their share price target between Rs320-Rs375 by 2025, taking into consideration their growth, market potential and strategic goals. Jio Financial Share Price Target Tomorrow 2025 To 2030

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 300 | 320 |

| February | 230 | 320 |

| March | 310 | 330 |

| April | 315 | 335 |

| May | 320 | 340 |

| June | 325 | 345 |

| July | 330 | 350 |

| August | 335 | 355 |

| September | 340 | 360 |

| October | 345 | 365 |

| November | 350 | 370 |

| December | 355 | 375 |

Jio Financial Services share price Target 2026

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 340 | 360 |

| February | 345 | 365 |

| March | 350 | 370 |

| April | 355 | 375 |

| May | 360 | 380 |

| June | 365 | 385 |

| July | 370 | 390 |

| August | 375 | 395 |

| September | 380 | 400 |

| October | 385 | 405 |

| November | 390 | 410 |

| December | 395 | 415 |

Jio Financial Services share price Target 2030

According to our study, Jio Financial Services may experience share price forecasts between Rs480 and Rs590 by 2030. Our estimation considers its long-term development potential, ability to innovate market conditions quickly, as well as Indian financial sector development growth.

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 450 | 480 |

| February | 460 | 490 |

| March | 470 | 500 |

| April | 480 | 510 |

| May | 490 | 520 |

| June | 500 | 530 |

| July | 510 | 540 |

| August | 520 | 550 |

| September | 530 | 560 |

| October | 540 | 570 |

| November | 550 | 580 |

| December | 560 | 590 |

Jio Financial Services share price Target 2040

Jio Financial Services may reach its share price goal between Rs2,200 to Rs2,700 by 2040 based on projected market leadership, technical advancement, and its capacity to capture large portions of Indian financial services sector marketshare. This estimate stems from market leadership predictions as well as expected technical innovations relating to Indian financial sector market shares.

| Scenario | Share Price Target |

| Minimum | ₹2,200 |

| Maximum | ₹2,700 |

Jio Financial Services share price Target 2050

According to our analysis, Jio Financial Services could achieve its target share price goal between Rs3,500 to Rs4,500 by 2050, taking into account long term company strategy, its capacity to utilize Reliance Group ecosystem and become global financial services leader.

| Scenario | Share Price Target |

| Minimum | ₹3,500 |

| Maximum | ₹4,500 |

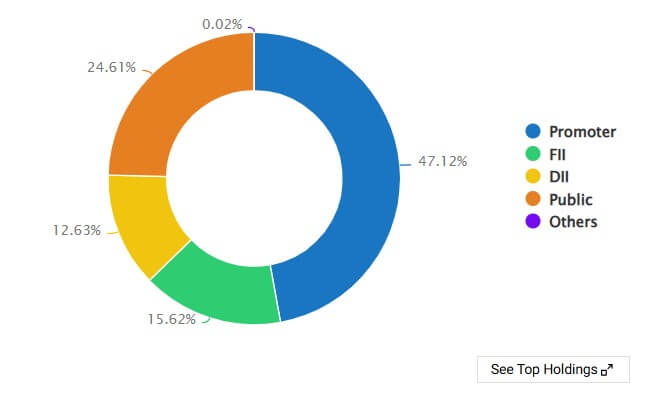

Jio Financial Services Ltd Shareholding Pattern

| Matrix | Dec 2024 |

|---|---|

| Promoters + | 47.12% |

| FIIs + | 15.62% |

| DIIs + | 12.46% |

| Government + | 0.17% |

| Public + | 24.61% |

| No. of Shareholders | 49,78,984 |

Jio Financial Services Ltd Competitors/Peer Companies

- Bajaj Finance

- Bajaj Finserv

- Jio Financial

- Bajaj Holdings

- Cholaman.Inv.&Fn

- Shriram Finance

- Muthoot Finance

Quarterly Results ( Jio Financial Share Price Target Tomorrow 2025 To 2030 )

| Period | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 |

|---|---|---|---|---|

| Sales + | 418 | 418 | 694 | 438 |

| Expenses + | 98 | 74 | 140 | 125 |

| Operating Profit | 320 | 344 | 553 | 313 |

| OPM % | 77% | 82% | 80% | 71% |

| Other Income + | 78 | 62 | 226 | 70 |

| Interest | 0 | 0 | 0 | 0 |

| Depreciation | 5 | 5 | 6 | 6 |

| Profit before tax | 393 | 400 | 773 | 377 |

| Tax % | 21% | 22% | 11% | 22% |

| Net Profit + | 311 | 313 | 689 | 295 |

| EPS in Rs | 0.49 | 0.49 | 1.08 | 0.46 |

Profit & Loss

| Period | Mar 2023 | Mar 2024 | TTM |

|---|---|---|---|

| Sales + | 45 | 1,855 | 1,968 |

| Expenses + | 6 | 296 | 437 |

| Operating Profit | 39 | 1,559 | 1,531 |

| OPM % | 88% | 84% | 78% |

| Other Income + | 10 | 429 | 435 |

| Interest | 0 | 10 | 0 |

| Depreciation | 0 | 22 | 22 |

| Profit before tax | 49 | 1,956 | 1,944 |

| Tax % | 37% | 18% | – |

| Net Profit + | 31 | 1,605 | 1,607 |

| EPS in Rs | – | 2.53 | 2.52 |

| Dividend Payout % | 0% | 0% | – |

Balance Sheet

| Period | Mar 2023 | Mar 2024 | Sep 2024 |

|---|---|---|---|

| Equity Capital | 2 | 6,353 | 6,353 |

| Reserves | 114,118 | 132,794 | 130,791 |

| Borrowings + | 743 | 0 | 0 |

| Other Liabilities + | 66 | 5,715 | 7,078 |

| Total Liabilities | 114,930 | 144,863 | 144,222 |

| Fixed Assets + | 158 | 172 | 171 |

| CWIP | 38 | 3 | 0 |

| Investments | 108,141 | 133,292 | 137,439 |

| Other Assets + | 6,593 | 11,395 | 6,613 |

| Total Assets | 114,930 | 144,863 | 144,222 |

Pros and Cons of Jio Financial

Pros

- Company debt has been greatly reduced. They are almost debt free.

- Stock is currently trading at 1.13 times its book value.

- Company Working Capital requirements have decreased from 1,832 days to 20.6 days.

Cons

- Though the company reports significant profits, no dividends are being distributed by it. Jio Financial Share Price Target Tomorrow 2025 To 2030

Factors that effect it’s share price

Jio Finance’s expected growth trajectory can be explained by innovative financial products, strategic partnerships and expanding customer bases; its share price may appreciate accordingly as the company solidifies its place within the financial services industry and captures more market share. Jio Financial Share Price Target Tomorrow 2025 To 2030

Market Trends: Jio Finance stands to capitalize on increasing digitization of financial services and demand for convenient banking solutions by investing in technology and customer-oriented offerings that could propel its growth trajectory and support increased valuations. Jio Financial Share Price Target Tomorrow 2025 To 2030

Economic Outlook: India’s long-term economic forecast holds promise of sustained expansion, creating favorable conditions for companies operating within its financial sector. As India expands and more people join formal financial systems such as Jio Finance’s offerings become popular and demanded, so will demand for their products and services increase accordingly. Jio Financial Share Price Target Tomorrow 2025 To 2030

Risk Considerations: It is crucial that investors carefully assess potential threats that could impede Jio Finance’s performance or share price targets, including regulatory changes, competitive pressures, technological disruptions and macroeconomic uncertainties that might threaten Jio’s share price targets and performance. Investors must carefully analyze these aspects when planning investment strategies accordingly.

Conclusion

Jio Finance has quickly established itself as an industry leader in digital financial services in India. Their strong technology, extensive network, and excellent customer service help propel rapid expansion. Jio Finance seeks to promote financial inclusion while offering safe financial products at accessible costs to every Indian citizen.

In this article, we have explored in great depth Jio Finance’s Share Price Target, business model, founders, management team, growth potential and future plans in detail. What has made Jio Finance successful are its top quality services that deliver commitment towards its customer needs; in future years Jio may reach new heights of digital financial services provision. Jio Financial Share Price Target Tomorrow 2025 To 2030

One thought on “Jio Financial Share Price Target Tomorrow 2025 To 2030”